お店で受け取る

(送料無料)

配送する

納期目安:

07月06日頃のお届け予定です。

決済方法が、クレジット、代金引換の場合に限ります。その他の決済方法の場合はこちらをご確認ください。

※土・日・祝日の注文の場合や在庫状況によって、商品のお届けにお時間をいただく場合がございます。

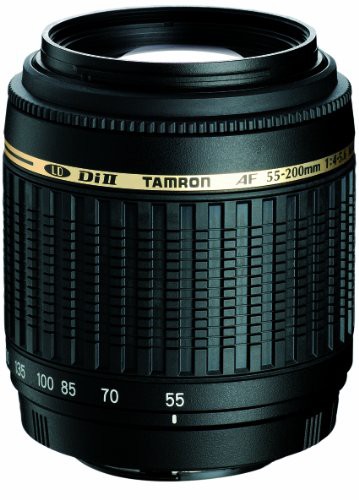

TAMRON AF 55-200mm F/4-5.6Di II LD MACRO デジタル専用 ソニーα用 A15M(中古品)の詳細情報

(中古品)

TAMRON AF 55-200mm F/4-5.6Di II LD MACRO デジタル専用 ソニーα用 A15M

【メーカー名】

タムロン

【メーカー型番】

5591

【ブランド名】

タムロン

【商品説明】

こちらの商品は中古品となっております。

画像はイメージ写真ですので商品のコンディション、付属品の有無については入荷の度異なります。

特典・付属品・パッケージ・プロダクトコード・ダウンロードコード等は付属していない場合がございますので、事前にお問合せ下さい。

買取時より付属していたものはお付けしておりますが、付属品や消耗品に保証はございません。商品ページ画像以外の付属品はございませんのでご了承下さいませ。

中古品のため使用に影響ない程度の使用感・経年劣化(傷、汚れなど)がある場合がございます。また、中古品の特性上、ギフトには適しておりません。

当店では初期不良に限り、商品到着から7日間は返品を受付けております。

他モールとの併売品の為、完売の際はご連絡致しますのでご了承ください。

ゲームソフトのご注意点

商品名に「輸入版 / 海外版 / IMPORT 」と記載されている海外版ゲームソフトの一部は日本版のゲーム機では動作しません。お持ちのゲーム機のバージョンをあらかじめご参照のうえ、動作の有無をご確認ください。

輸入版ゲームについてはメーカーサポートの対象外です。

DVD・Blu-rayのご注意点

商品名に「輸入版 / 海外版 / IMPORT 」と記載されている海外版DVD・Blu-rayにつきましては映像方式の違いの為、一般的な国内向けプレイヤーにて再生できません。ご覧になる際はディスクの「リージョンコード」と「映像方式※DVDのみ」に再生機器側が対応している必要があります。パソコンでは映像方式は関係ないため、リージョンコードさえ合致していれば映像方式を気にすることなく視聴可能です。

商品名に「レンタル落ち 」と記載されている商品につきましてはディスクやジャケットに管理シール(値札・セキュリティータグ・バーコード等含みます)が貼付されています。ディスクの再生に支障の無い程度の傷やジャケットに傷み(色褪せ・破れ・汚れ・濡れ痕等)が見られる場合があります。予めご了承ください。

2巻セット以上のレンタル落ちDVD・Blu-rayにつきましては、複数枚収納可能なトールケースに同梱してお届け致します。

トレーディングカードのご注意点

当店での「良い」表記のトレーディングカードはプレイ用でございます。中古買取り品の為、細かなキズ・白欠け・多少の使用感がございますのでご了承下さいませ。

再録などで型番が違う場合がございます。違った場合でも事前連絡等は致しておりませんので、型番を気にされる方はご遠慮ください。

ご注文からお届けまで

1、ご注文⇒ご注文は24時間受け付けております。

2、注文確認⇒ご注文後、当店から注文確認メールを送信します。

3、お届けまで3〜10営業日程度とお考え下さい。

※海外在庫品の場合は3週間程度かかる場合がございます。

4、入金確認⇒前払い決済をご選択の場合、ご入金確認後、配送手配を致します。

5、出荷⇒配送準備が整い次第、出荷致します。発送後に出荷完了メールにてご連絡致します。

※離島、北海道、九州、沖縄は遅れる場合がございます。予めご了承下さい。

当店ではすり替え防止のため、シリアルナンバーを控えております。万が一すり替え等ありました場合は然るべき対応をさせていただきます。

お客様都合によるご注文後のキャンセル・返品はお受けしておりませんのでご了承下さい。

電話対応はしておりませんので質問等はメッセージ、メールにてお願い致します。

(中古品)TAMRON AF 55-200mm F/4-5.6Di II LD MACRO デジタル専用 ソニーα用 A15M/タムロン/5591/タムロン/TAMRON AF 55-200mm F/4-5.6Di II LD MACRO デジタル専用 ソニーα用 A15M/A15M

ベストセラーランキングです

近くの売り場の商品

カスタマーレビュー

オススメ度 4.4点

現在、29件のレビューが投稿されています。